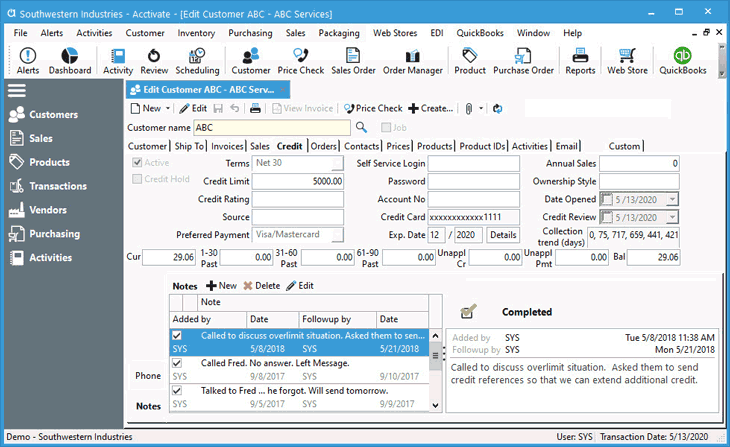

Customer Credit Tab

The customer Credit tab presents all customer credit management information for each customer. Users can view a customer’s current balance, past due balances, and unapplied credits or payments on this tab.

Useful functions on the customer Credit tab include:

- Active: Mark a customer as being active or inactive by toggling checkbox. The sync updates the related customer record in QuickBooks.

- Credit Hold: This checkbox is used to control sales to accounts that are not credit worthy. A credit hold can be applied to a customer so that all open orders and future orders cannot be processed unless the credit hold is released. Accounts in this category require special approval before an order can be processed.

- Terms: Default payment terms for the account. This can be updated on individual sales orders with the proper set of user permissions. Terms Codes are maintained in QuickBooks and utilized in Acctivate.

- Credit Limit: Assign a customer credit limit to limit amount allowed to purchase on credit. A credit limit is the maximum amount of credit that you will extend to a debtor for a line of credit (sometimes called a credit line, line of credit, or a tradeline). This limit serves as a secondary determination of credit worthiness during order entry.

- Credit Rating and Source: This information can be gleaned from a credit reporter, such as Equifax.

- Preferred payment: Set the preferred payment method for the customer. This list is maintained in QuickBooks.

- Account No: Assign a customer account number.

- Credit Card: When setting to a credit card type as preferred payment, you can enter the default card information in this field. The last 4 digits and expiration date are displayed on this window. With the proper permission, users can also enter the CC Details. Customer credit card numbers are encrypted at the highest level and never printed in entirety.

- Date Opened: The date of account opening.

- Credit Review: Date of last customer credit review.

- Collection Trend: Displays a series of up to the 12th most recently paid invoices in days.

- Balance Information: Current, past due invoices, unapplied credits, unapplied payments, and balance totals.

Customer Credit Card Info

All customer credit card information, except the Card Security Code (e.g. CVC) can be stored and maintained in Acctivate. This data is highly secure and protected. Customer credit card numbers are encrypted at the highest level and never printed in entirety. Only users with proper permission to maintain customer credit cards can enter and modify credit card information for each customer.

With a combination of preferred payment method and customer credit card details, users can choose the preferred method on the sales order for Acctivate to prefill the stored CC information. Start by selecting a Preferred Payment method which is marked as a CC from the drop down. Once selected, add the customer Credit Card Details:

- Select a CC payment option from the Preferred Payment drop-down. Payment Methods are maintained in QuickBooks but can be marked as being a credit card in Configuration Management.

- Click Details button in Credit Card section.

- Enter or update Credit Card number, Exp. Date, and Name on Card. The Address and ZIP Code fields are optional.

- Click OK.

- Save changes to customer.

Additional Tabs on Left-Hand Side of Customer Credit Tab

In addition to the credit settings, users can add specific contact information for billing, as well as add Notes. The Phone and Notes are specific to the customer credit tab.

- Phone: Use when there is a unique billing contact outside of the main Billing information listed on the Customer tab.

- Notes: Add Notes from calls regarding credit status or for another user to followup on in the future. When creating a Note from the Credit tab, the icon on the Reminder changes to be specific to credit.