Calculating Landed Cost with Acctivate

Built For

Landed cost is the total cost associated with getting your inventory into your hands. It’s more than just the purchase price of your products – it also includes additional expenses like freight, insurance, customs duties, and handling fees. These costs are essential to account for because they give you a true picture of your Cost of Goods Sold (COGS) and ultimately influence your pricing strategy and profit margins.

Without accurately calculating landed cost, you risk underpricing your products, reducing profitability, or overpricing and potentially losing customers. Acctivate makes calculating landed costs easy, ensuring precise inventory valuations and competitiveness for your business.

Let’s explore how Acctivate helps you manage and allocate landed costs effortlessly.

Entering Landed Costs in Acctivate

Acctivate offers two primary ways to enter landed cost, depending on whether the additional fees come from the same vendor as the purchase order or a separate vendor. This flexibility allows you to handle different purchasing scenarios accurately.

Option A: Landed Cost from the Original Purchase Order Vendor

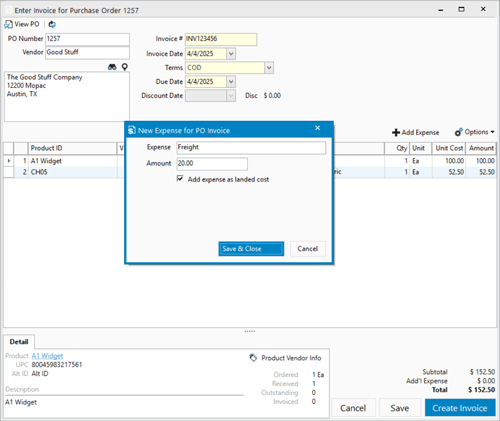

Sometimes, the vendor you purchased your inventory from will include extra costs, such as freight or insurance, on the same invoice. In Acctivate, you can seamlessly incorporate these additional costs when invoicing the purchase order.

As you process the invoice, you simply record these fees using the “Add Expense” window and mark them as landed costs. This ensures the extra charges are added to your inventory value rather than treated as regular expenses.

Acctivate then prompts you to allocate these costs across the items in the purchase order. By doing this, your inventory values and Cost of Goods Sold (COGS) reflect the true cost of bringing the products into your business. This method streamlines the process and helps you maintain accurate financial records without extra steps.

Option B: Landed Cost from a Separate Vendor

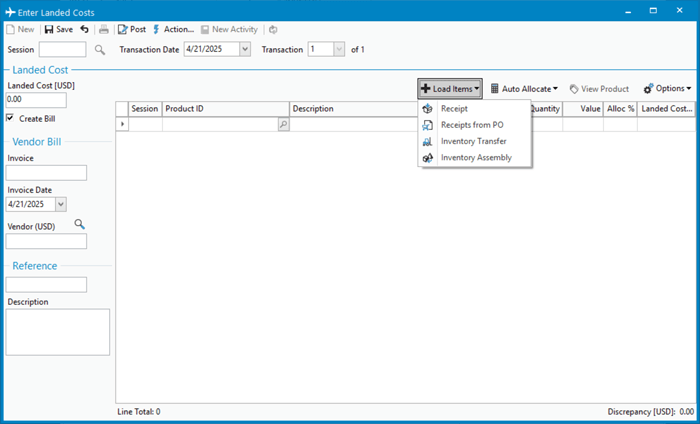

In many cases, additional costs like shipping fees, customs duties, or handling charges come from vendors other than those supplying your inventory. Acctivate makes it simple to handle these separate costs through the Landed Cost function.

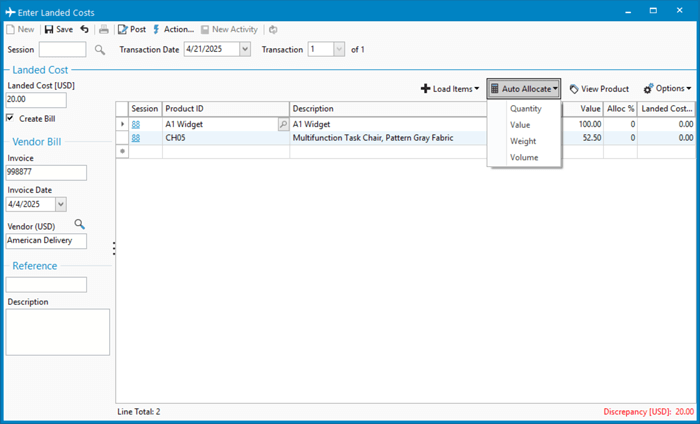

You start by creating a new Landed Cost session and entering the vendor’s details and associated costs. Acctivate allows you to link these costs to specific inventory transactions, such as receipts, transfers, or purchase orders. This flexibility is beneficial when a single bill covers costs for multiple shipments or inventory movements.

Once you’ve linked the costs, you can allocate them across the relevant items. Acctivate ensures these expenses are incorporated into your inventory valuation accurately, giving you a complete and precise picture of your landed costs.

Allocating Landed Costs

Once you’ve entered the landed cost, the next step is to allocate it among the items in your inventory. Acctivate provides several methods for allocating these costs, ensuring they are spread in a way that makes the most sense for your business.

Allocation Methods

Acctivate allows you to allocate by:

- Quantity: Spread the cost evenly based on the number of units.

- Value: Allocate cost proportionally based on the item’s value.

- Weight: Assign costs based on the weight of the items.

- Volume: Allocate costs according to the volume the items occupy.

Using the Landed Cost Factor

For even greater precision, you can use the Landed Cost Factor. This factor acts as a multiplier to adjust the allocation for specific items. For example:

- 0: Exclude the item from allocation.

- 1: Standard allocation.

- 2: Double the cost allocation for that item.

- 0.5: Halve the cost allocation for that item.

This is useful when some items in a shipment disproportionately contribute to the total landed cost.

Finalizing Landed Cost Allocation

When you’re satisfied with the allocation, update your inventory with the new cost. If you’re not ready to commit, you can save the entry without posting it.

Acctivate ensures the accuracy of your accounting records by adjusting inventory values and related accounts accordingly. This helps maintain transparency and consistency in your financials.

Acctivate is Your Go-To for Landed Cost Calculation

- Accurate Inventory Valuation: Ensure you know the full cost of your products, preventing under- or over-pricing.

- Flexible Allocation: You can allocate costs by quantity, value, weight, or volume—whatever best suits your business.

- Simplified Accounting: Automated postings mean fewer manual adjustments and reduced errors.

- Transparency: Detailed cost breakdowns help you understand where your money is going.

- Seamless Integration: Acctivate integrates seamlessly with QuickBooks, keeping your financial data in sync. Whether you’re dealing with purchase orders, vendor invoices, or added costs, Acctivate ensures your accounting stays accurate.

Master Landed Costs with Acctivate

Understanding and managing landed costs doesn’t have to be a challenge. With Acctivate, you can effortlessly track, allocate, and apply additional costs to your inventory. This ensures accurate valuations, informed pricing decisions, and healthier profit margins. Acctivate eliminates the guesswork of landed costs, allowing you to focus on what you do best: growing your business.

For Acctivate users

Training: Allocating Other Amounts Listed on Vendor Bill via Landed Cost

Training: Vendor Bill Allocation to Inventory Cost

Knowledge Base: Using Landed Cost

Knowledge Base: The Landed Cost Factor

Knowledge Base: What is Landed Cost?

Knowledge Base: Configuring Landed Cost Account

Knowledge Base: Adding Additional Costs to a Purchased Product

Call us at 817-870-1311