What is Landed Cost?

Built For

- The components of landed cost

- How to calculate landed cost accurately

- Best practices for managing landed cost

What is Landed Cost?

We are frequently asked, “What is landed cost?” In the intricate dance of global trade, understanding the total cost of delivering products to your doorstep is akin to deciphering a complex choreography.

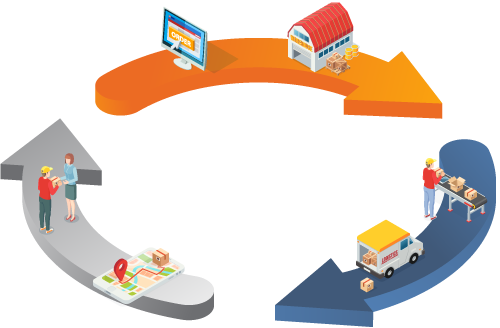

At its core, landed cost is the total cost of a product once it has arrived at a buyer’s door. Landed cost encompasses every expense incurred along the journey from the seller’s location to the final destination. It culminates various charges, including the original purchase price, transportation fees, customs, duties, taxes, insurance, currency conversion, and other handling fees.

Why does landed cost matter? For businesses venturing into international trade, it is the cornerstone for pricing strategies, affecting everything from profit margins to competitive positioning. Without a precise understanding of landed costs, a business can easily find itself in a quagmire of unexpected expenses, eroded profits, or even regulatory non-compliance. Thus, mastering the concept of landed cost is beneficial and a fundamental aspect of staying afloat in the tempestuous seas of international commerce.

As we delve into landed cost, we’ll uncover its various components, the challenges in calculating it accurately, and the best practices for managing these costs effectively. Whether you’re a seasoned trader or new to the global market, grasping the full scope of landed costs will empower you to make informed decisions, optimize your supply chain, and enhance your business’s profitability. So, let’s embark on this journey together and demystify the landed cost, ensuring that your business survives and thrives in the global marketplace.

Components of Landed Cost

Let’s put on our detective hats and sift through the bits and bobs that add up to the landed cost. Think of it as the ultimate shopping list for bringing your product from far-off lands to your cozy warehouse.

- Cost of Goods: This is the base price tag—the amount you pay for the product. Pretty straightforward, right? Whether buying plush toys or high-tech gadgets, it all starts with this number.

- Shipping Fees: Products don’t magically teleport (not yet, anyway). They travel by ship, plane, truck, or a combination of these. What is the cost of moving goods from point A to point B? That’s shipping, which can vary widely based on speed, weight, and distance.

- Insurance: It’s the safety net for your goods on the move. If a storm decides to throw a tantrum or a crate goes AWOL, insurance is that reassuring pat on the back that says, “We’ve got you covered.”

- Customs Duties: As goods cross borders, they often encounter the tax collector of the international trade world—customs. These duties depend on the product type and the countries you’re dealing with. They can be pesky to calculate but ignore them at your peril!

- Taxes and Tariffs: In addition to duties, some countries also charge additional taxes or tariffs on imported goods. This is like the final boss in a video game; you need to clear this level to get your goods home.

- Currency Conversion Costs: Dealing with suppliers overseas? Then you’re playing in the foreign exchange market, where currencies fluctuate like waves. Conversion costs can nibble away at your margins if you’re not careful.

- Handling Fees: Once your goods land, they must still be unloaded, stored, and prepped for their final journey. These handling fees are like tipping your porter; it’s for the legwork at the docks or along the way to your warehouse.

- Other Potential Fees: There’s always a “miscellaneous” category, isn’t there? This can include port fees, brokerage fees, and anything else that pops up unexpectedly.

So, there you have it—the total landed cost for your product’s grand voyage. Keeping track of these components is crucial to anticipate the final bill and ensure your product pricing is on point. Neglecting even one element can mean the difference between profit and loss. Now, let’s dig into each of these components and see how they can affect your bottom line.

The Significance of Calculating Landed Cost

Now that we’ve unpacked the landed cost components let’s chat about why getting this calculation right is critical.

Why Accuracy Matters

First up, pricing your products. If you’re off the mark with your landed cost, you might either price yourself out of the market or, worse, sell at a loss. And nobody’s in business to lose money, right?

Next, let’s talk about profit margins. A clear view of your landed costs gives you the X-ray vision to ensure you’re not just breaking even but making the dough.

Landed costs also plays a significant role in decision-making. If you know the exact cost of getting those fancy lamps from Italy, you can decide whether to stick with them or switch to a supplier closer to home who might offer a better deal.

Beyond the Numbers

Calculating landed costs is not just about the immediate costs; it’s about seeing the whole chessboard. It can impact your inventory management, like deciding how much stock to keep on hand.

And let’s not forget about competition. Knowing your actual costs helps you stay competitive without shortchanging yourself. It’s about finding that sweet spot between being the low-cost leader and the premium provider.

When Mistakes Happen

If you underestimate your landed cost, it’s like inviting your friends over for dinner and running out of food—embarrassing and costly. Overestimate and you might overcharge and scare off customers with high prices. Calculating landed costs with precision is a balancing act that can make or break your business.

Challenges in Calculating Landed Cost

Let’s face it—calculating landed costs can sometimes feel like solving a Rubik’s Cube blindfolded—frustrating and complex. But why is it so tricky?

- Variability of Costs: Shipping rates and customs duties can swing unpredictably. Fuel prices soar, political climates change, and just like that, your costs are doing the tango when you expected a waltz.

- Complex International Regulations: Every country has its rules, and navigating them can be a monumental task for any business.

- The Surprise Factor: Sometimes, fees come out of nowhere, like a plot twist in a thriller novel. You might get slapped with an unexpected tariff or a sudden increase in port fees.

- Currency Conversion Whiplash: Exchange rates are about as stable as a house of cards in a windstorm. They can fluctuate faster than you can say “international finance,” causing your estimated costs to bounce around.

- The Human Element: Yep, good old human error. Miscalculations happen, and they can throw your entire budget off track. Who knew a misplaced decimal could cause so much drama?

- Inconsistent Pricing Among Suppliers: Suppliers’ pricing consistency (or lack thereof) can make it difficult to predict costs and compare options effectively.

The Role of Inventory Management Software

So, with all these hurdles, how do you glide through the process? Inventory management software can assist by handling much of the heavy lifting regarding landed costs.

Automated Calculations

Say goodbye to manual math and hello to automated accuracy. Inventory management software can calculate complex landed cost formulas, ensuring you always work with the correct numbers.

Regulatory Compliance

Staying in compliance is a cinch when your software has the tools to track and manage compliance requirements, reporting, and documentation.

Historical Data Analysis

Learn from the past with easy access to historical data, allowing you to spot trends, predict future costs, and make smarter buying decisions.

Integrated Workflow

Everything from purchasing to sales is centralized in inventory management software, giving you a cohesive view of your business operations and how landed costs tie into every stage.

By implementing inventory management software, you’re not just simplifying your landed cost calculations; you’re empowering your business to navigate the high seas of international trade with a seasoned captain at the helm.

What is Landed Cost? FAQs

What is landed cost?

Landed cost is the total cost of a product once it has arrived at your warehouse, encompassing the cost of goods, shipping, insurance, customs duties, taxes, tariffs, currency conversion, handling fees, and more.

What is the primary purpose of calculating landed cost?

The primary purpose of calculating landed costs is to determine the total cost of a product once it arrives at your warehouse so you can set appropriate prices, maintain profit margins, and make informed business decisions.

Can landed costs vary over time?

Landed costs can vary due to changes in shipping rates, currency exchange rates, and international duties and taxes.

Why do currency conversion rates affect landed costs?

Currency conversion rates affect landed costs because international purchases and sales often involve multiple currencies, and exchange rate fluctuations can decrease or increase the final cost in your home currency.

How does inventory management software help manage landed costs?

Inventory management software helps by automating the calculation of landed costs, updating costs in real-time, assisting with regulatory compliance, comparing suppliers, and analyzing historical data to make accurate predictions for future expenses.

Call us at 817-870-1311