Built For

Advanced Cost Methods for Every Business

Acctivate’s Advanced Cost Method options offer flexible inventory cost tracking and control across your entire business.

Acctivate offers Average, Standard, FIFO, LIFO, and Specific Identity Cost Methods.

Select which cost method is right for each product/item in your inventory.

Tie purchase and added costs to a unique product by serial number or a group of products by lot number.

Control COGS & gain clear insight into the cost layers of each product by using or selling the oldest or recently purchased inventory first.

Take added costs accumulated along the procurement process and land them into the related shipment or products.

Manage and track cost at the warehouse level for better cost analysis and reporting.

Call us at 817-870-1311

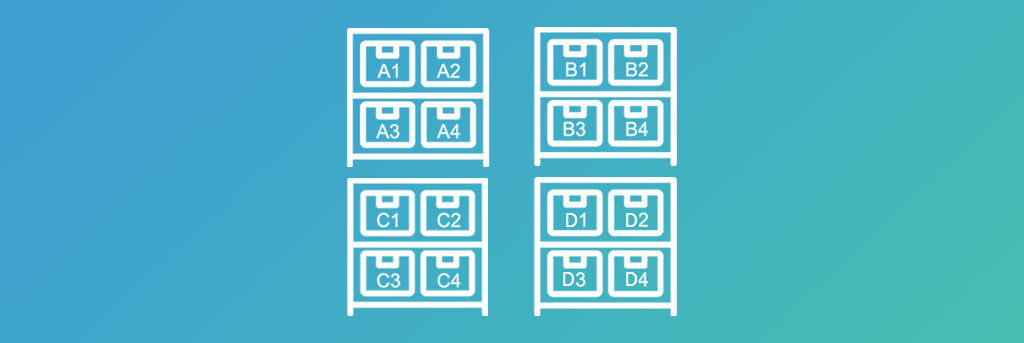

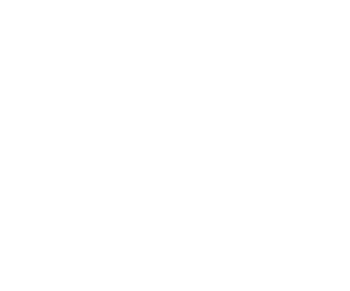

Selecting a cost method

Choose the Right Cost Method at the Product Level

Not all products or items are the same, so you should expect that your cost method will vary too.

Acctivate offers 5 different options for tracking your inventory cost including, average, LIFO, FIFO, standard and specific-identity.

The best part? Acctivate allows you to select the cost method for each new product you create, allowing you to isolate inventory cost based on product attributes and use-case.

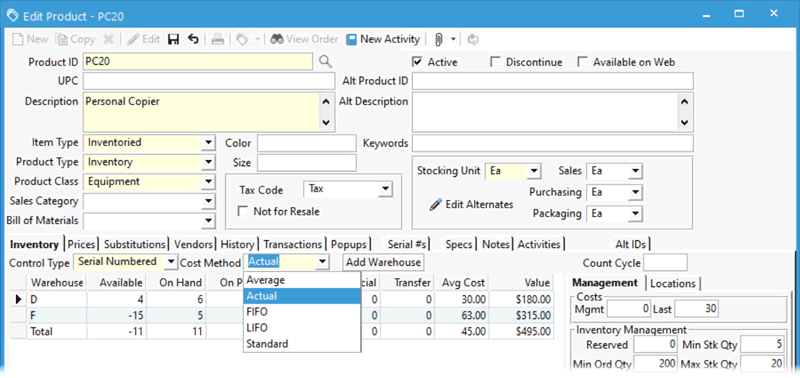

FIFO/LIFO Layers

See Full Visibility of FIFO and LIFO Cost Layers

Using FIFO (First-In, First Out) and LIFO (Last-In, First Out) cost methods offer the ability to control COGS by utilizing the oldest or most recent cost incurred for a product.

This type of cost accounting can be advantageous for some businesses, and for those Acctivate allows you maximum visibility of the cost layers for each product.

*It’s important to note, this type of cost accounting carries strict IRS rules, and you should always consult your CPA before choosing one of these cost methods.

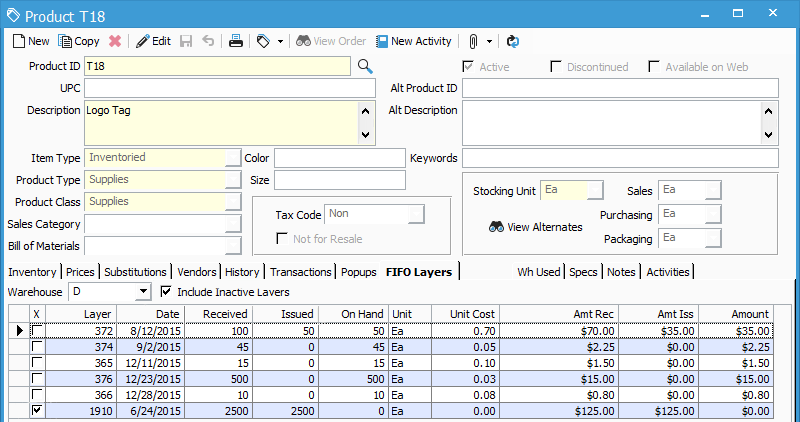

Cost by lot/serial number

Precise, Granular Costing at the Lot & Serial Number Level

Accurately capture Cost of Goods Sold with the ability to associate multiple costs to the different lot and serial numbers of a single product.

Unique unit costs can be tied to each individual serial number and lot number, which are defined upon inventory receipt and remain tied to the serialized or lot controlled product when they are sold.

landed cost

Calculate True Cost of Goods Sold by Automatically Capturing All Additional Costs

Know the true inventory valuation of all products by having additional costs beyond the purchase price (i.e., duties, taxes, VAT, government fees, customs, freight, insurance, etc.) accurately allocated across one or more transactions based on quantity, value or weight of a product.

Landed cost can be figured at any point, whether the costs are known at the time of receipt of the goods, or afterwards.

With landed cost attributed correctly, businesses can make informed decisions concerning product sourcing & profitability.

Explore more of Acctivate…

Call us at 817-870-1311