Credit and Collection Features

Acctivate allows you to enable Customer Credit Restrictions, maintain Customer Credit Information, set Customer Credit Holds, Override Credit Holds, mark Invoices in Dispute, Track Collection Efforts, and set User Permissions. Efficient credit and collection management is critical for optimizing customer relationships, minimizing risk and maximizing cash flow. Acctivate has the tools to enable businesses to stay up to date on any customer credit issues and act.

Credit Restrictions

Starting off, you can configure settings that will help you control credit delinquent customers. Acctivate automatically places a customer on credit hold or on over the limit status based on the credit restrictions you set in the Configuration Manager. In configuration you can:

- Deny credit if invoices are overdue

- Set a grace period for overdue invoices

- Deny credit if the customer goes over their credit limit

- Set the customer credit value at zero or unlimited

Learn more about setting credit restrictions >

Additionally, in configuration, you have the option to include open sales and service orders in calculating a customer’s credit status, as well as unbilled time and materials on business activities if you have the Service Billing add-on module. Customers are placed on credit hold immediately if an open sales order, open service order or unbilled time and materials are putting them over their credit limit thus preventing an overcharge.

Override Orders for Customers with Credit Issues

When a customer is on credit hold or they’re over their credit limit a warning will show on any sales order entered for that customer. The warning on the order window will appear as a button with “Credit Hold” or “Over Limit” in red on the right side of the Sales Order window in the Header tab. If one of these statuses needs to be overridden, a user with permission can simply click the button while in edit mode and override that status, so that the sales order can be processed.

Once the credit status is approved, the red warning on the button then changes to a green “Credit Approved” message. Under the credit status button, the user that approved the credit for the sales order is recorded along with the date they did it.

Overriding in this manner, only releases the credit held or over limit status for the selected sales order, the customer remains under the credit status. All other sales orders for this customer will remain on hold until the overall customer credit issue has been addressed, including subsequently entered sales orders. A red “Overdue”, “Credit Hold” or “Over Limit” warning will show on the Customer List and Edit Customer window for the specific customer and details will appear in the Credit tab.

Disputed Invoices

Another feature in Acctivate is the ability to mark invoices as “in dispute”. If a customer disputes an invoice and you agree to continue to process customer orders while the matter is investigated, the invoice can be marked as such via a checkbox. This will allow the invoice to be excluded from the customer’s credit evaluation.

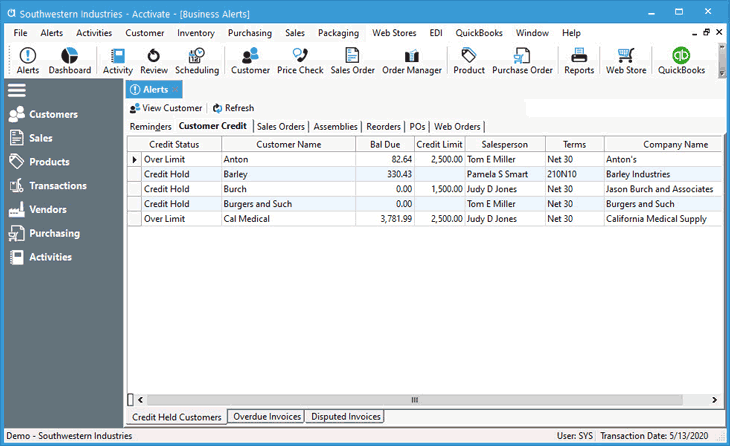

Track Collection Efforts with Business Alerts & Notes

Acctivate allows you to easily track and manage accounts receivable collection efforts with alerts and the ability to record notes directly on the Enter Customer window > Credit tab. These are managed on the Reminders tab of the Alerts window. With this functionality users can create notes which require a follow-up on credit management tasks with ease. Additionally, the Alerts > Customer Credit tab allows you to review credit held customers and their current credit status. You will know who is under credit hold, who has overdue invoices and the invoice details, which invoices are in dispute and all past and present records of collection efforts.

Learn how to use Business Alerts and notes to effectively track collections >

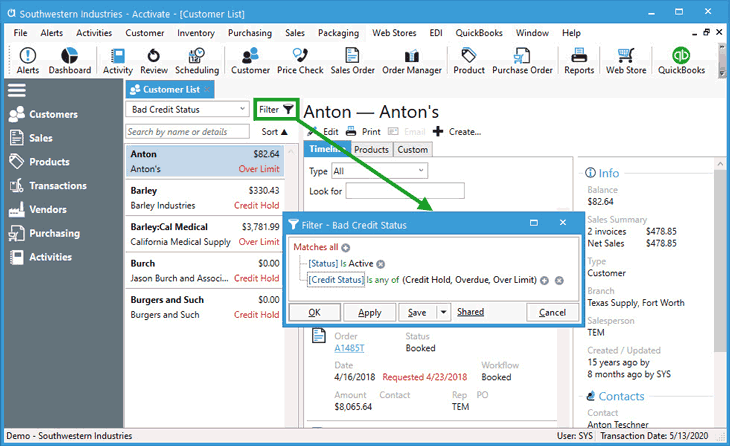

Filter Customer List Based on Credit Status

In addition to Business Alerts, users can create and save custom filters on the Customer List to review customers with bad credit. Create a custom filter on the list which filters based on Credit Status being a specific value or a list of values. For instance, add Status of Active and Credit Status “Is any of” Credit Hold, Overdue, Over Limit to a custom customer list filter. Save for all users or keep it to yourself for credit management in the future.

As you can see, Acctivate is not just inventory management, it also can help you handle credit issues, so that your business has greater control, better collections, fewer long overdue invoices and better customer relationships.

Over Limit

A credit limit occurs automatically if the customer has exceeded their allowed credit limit. This is set on the Edit Customer window > Credit tab. See this article on credit restriction configuration.

Overdue

If the option “Deny credit if invoices overdue” is selected in the customer window of the configuration manager, then past due invoices will place a hold on open and future sales orders. This will be evident by the words “Overdue” in red on the customer’s sales orders and upper right hand of the customer window.

Granting Acctivate users’ access

By default, none of the Acctivate users will have access to the credit card information until the system administrator grants them permission.

Follow the steps below to give the necessary users permission to view or maintain credit card information:

- Select File > Configuration Management to open the Configuration Manager.

- Select User > User Information.

- Expand the folder of the Acctivate user for whom you need to set the permission level.

- Expand the Customer Info folder.

- Select the Credit Card Information folder and click the Edit button.

- In the Permission section at the top-right, select the appropriate permission level for the user from the Credit Card Information drop-down menu. You can choose from three permission levels:

- Not allowed – Will not be able to view or maintain credit card information.

- View only – Will only be able to view credit card information, not maintain it.

- Maintain – Will be able to view and maintain credit card information